The Guyana Revenue Authority (GRA) has released a statement in response to the High Court’s recent ruling in the matter of Azruddin Mohamed against the Commissioner General and the Revenue Authority.

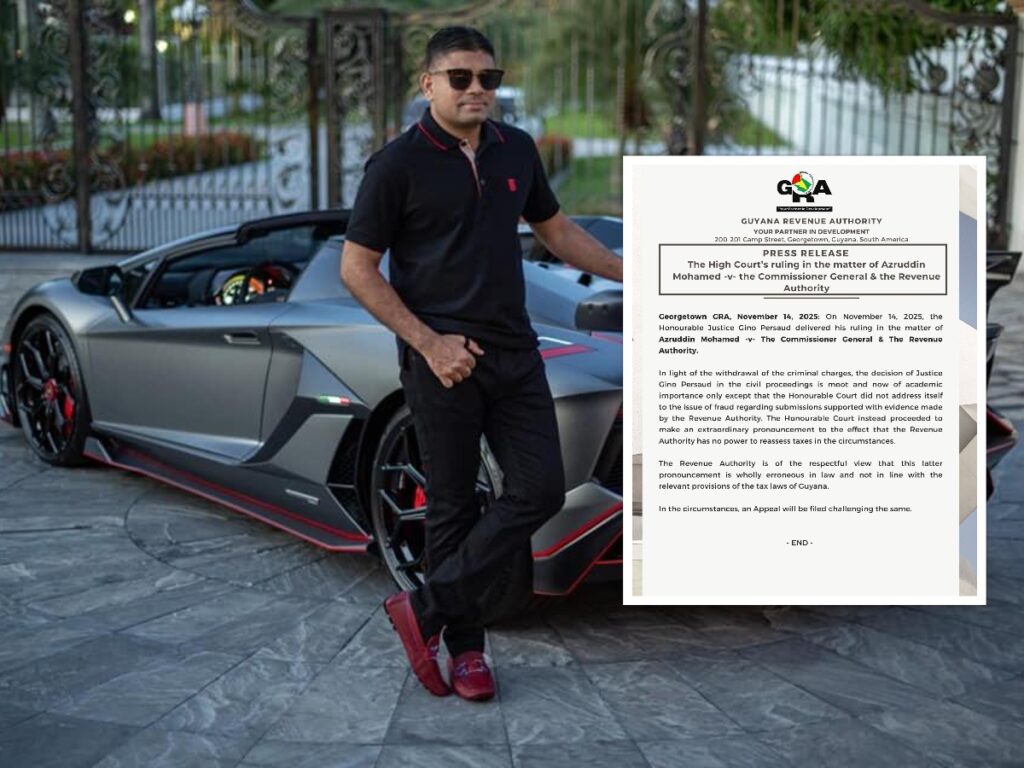

On November 14, 2025, Justice Gino Persaud ruled that the GRA’s reassessment of taxes on three luxury vehicles imported by Mohamed was unlawful and blocked the seizure of the vehicles. The court found that the imposition of additional taxes totaling $421 million was arbitrary and lacked legislative support.

In its statement, the GRA expressed its respect for the court’s decision but reiterated its belief that the agency acted within its rights in assessing the tax obligations of Mohamed. The GRA asserted that the ruling did not take into account the agency’s fundamental responsibilities to uphold tax laws and ensure compliance.

The agency acknowledged the judge’s comments regarding the timing of the tax reassessments and expressed its commitment to thorough investigations into any instances of fraud, as noted by Justice Persaud. The GRA mentioned that it would seek to clarify its position and the circumstances surrounding the tax assessments in a future appeal.

“While we respect the outcome of this judgment, we remain steadfast in our duty to ensure that all taxpayers comply with their obligations,” the GRA stated in the release. “The Revenue Authority has a responsibility to pursue any discrepancies in declared values based on market standards.”

The GRA confirmed its intention to appeal the ruling, aiming to seek a review of the court’s decision in light of its interpretation of tax law compliance.

As this matter continues to unfold, both sides remain positioned for a protracted legal battle surrounding the interpretations of tax assessments and the enforcement of revenue collection.

![]()