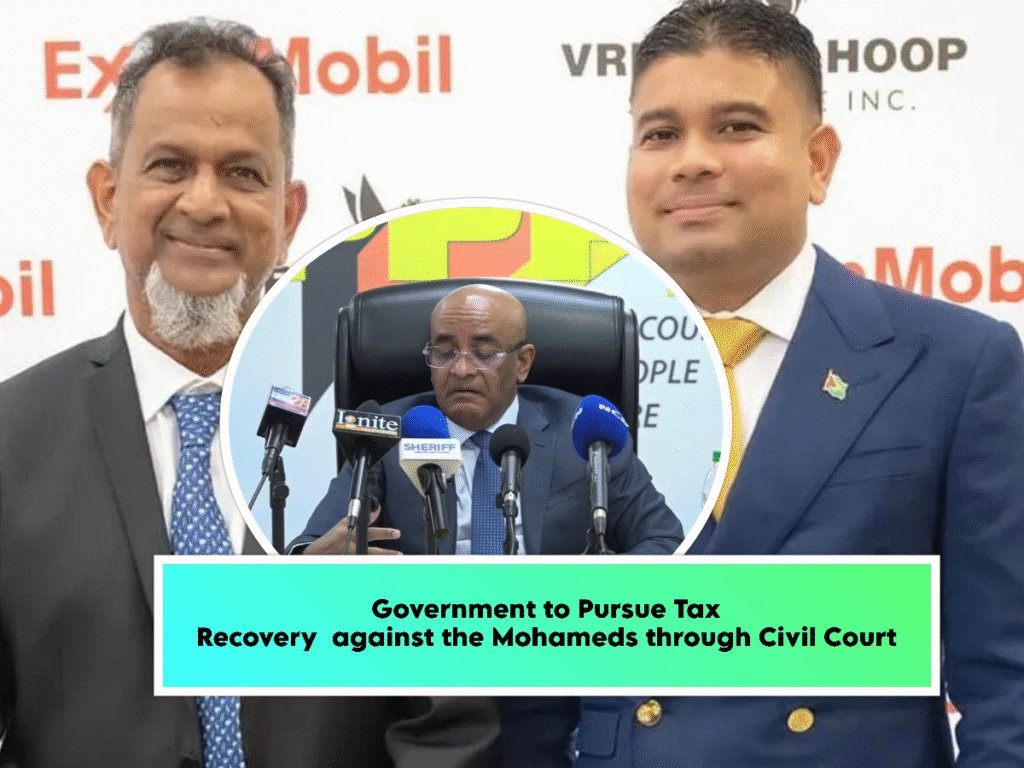

The Guyana Revenue Authority (GRA) has withdrawn all tax-related charges against U.S.-indicted businessmen Nazar and Azruddin Mohamed. However, the State will continue to pursue the recovery of the taxes owed.

During a press conference on Thursday, Vice President Dr. Bharrat Jagdeo clarified that the withdrawal of the charges does not hinder the State’s ability to seek recovery through civil court. “You have to pay the taxes,” Jagdeo emphasized, noting that the civil remedy for the taxes owed is already underway. “They got the demand notice for the $191 billion already… that’s calculated based on the penalties, that’s not going to stop,” he stated.

Attorney General Anil Nandlall echoed this sentiment in a Facebook post, asserting that “extradition apart, the State of Guyana retains its full plenitude of legal powers to secure all taxes due, owing and payable, and intends to do so, in accordance with law.”

The initial charges, filed by GRA Commissioner-General Godfrey Statia, alleged that the duo significantly understated their taxable income from gold exports between 2020 and 2024. Nazar Mohamed was accused of underreporting approximately $29.12 billion, while Azruddin Mohamed allegedly failed to declare around $3.61 billion, resulting in a total underreported amount of roughly $32 billion.

The GRA explained that the charges were withdrawn to facilitate a U.S. extradition request for the father and son, who have been indicted by a U.S. grand jury on charges including conspiracy, mail and wire fraud, money laundering, and gold smuggling.

Guyana Dominates CSEC and CAPE: Queen’s College Duo Tops the Caribbean

![]()