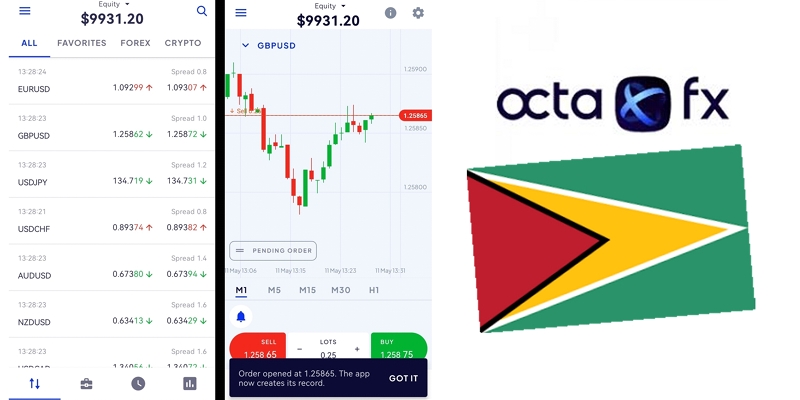

How to trade forex with Octafx Broker in Guyana

Table of Contents

Hello, it’s Job Ads Publisher with another blog post, In this article, I will break down how you can trade forex with Octafx Broker in Guyana. Before I get into the details of this article, I would like to leave a disclaimer below.

“Trading futures, forex, CFDs, and stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results.”

Many visitors to my blog usually comment on my previous post on how to start trading forex in Guyana, I wrote previous articles on this very topic but after doing some research I found this broker that allows you to fund your forex account with ease once you have access to a Visa card.

What is forex trading and how does it work?

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies on the foreign exchange market with the aim of making a profit. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion USD.

Here’s a brief overview of how forex trading works:

Currency Pairs: In forex trading, currencies are always traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). Each currency in the pair is represented by a three-letter code, and the first currency listed is the base currency, while the second is the quote currency.

Bid and Ask Prices: The bid price is the price at which the market is willing to buy a currency pair, while the ask price is the price at which the market is willing to sell a currency pair. The difference between the bid and ask prices is known as the spread.

Leverage: Forex trading often involves the use of leverage, which allows traders to control a larger position size with a relatively small amount of capital. While leverage can amplify profits, it also increases the potential for losses, so it should be used with caution.

Speculation: Most forex trading is speculative in nature, with traders aiming to profit from changes in exchange rates. Traders can take either long (buy) or short (sell) positions depending on their expectations for how a currency pair will move.

Market Participants: The forex market is composed of various participants, including central banks, commercial banks, hedge funds, corporations, and individual retail traders. Each participant plays a role in influencing exchange rates through their trading activities.

Trading Platforms: Forex trading is typically conducted through online trading platforms provided by brokers. These platforms offer access to real-time price quotes, charts, technical analysis tools, and order execution capabilities.

Risk Management: Successful forex trading requires effective risk management strategies to protect against potential losses. This may include setting stop-loss orders to limit losses on individual trades, diversifying trading strategies, and maintaining proper position sizing.

Market Hours: Unlike stock markets, the forex market operates 24 hours a day, five days a week, starting with the opening of the Asian session on Sunday evening and closing with the New York session on Friday afternoon (Eastern Time).

Overall, forex trading offers profit opportunities, but it also carries inherent risks. It requires a good understanding of market fundamentals, technical analysis, and risk management principles to trade successfully.

Now that I have highlighted a brief overview of forex trading and how it works, how can you get started?

Getting started with Octafx is very simple, The signup process is simple as they allow you to trade in-app. This means instead of installing a MetaTrader app and connecting outside brokers, the Octafx broker platforms provide meta traders embedded into their platform, allowing you to trade directly into the app. This is very convenient for forex traders.

How to install the Octafx app?

Whether you have an Android or iPhone, you can download and install the Octafx broker app using the link below :

Upon installing the Octafx app you can verify your account by submitting a photo of your ID card. This is important to authenticate your account. This will also allow you to secure your account from outsiders getting access, as each transaction is bound by your information and contact number.

How do I fund my Octafx broker account to start trading in Guyana?

Before funding your account, you will need to familiarize yourself with cryptocurrency, as these platforms are now making cryptocurrency their main method of depositing.

A lot of Guyanese are not comfortable with the topic of cryptocurrency, but if you do research, you will realize cryptocurrency is one of the easiest ways to transfer money globally, and it’s also the fastest way to go about doing it.

You will also need to have a crypto wallet to store your cryptocurrency. I would suggest a few crypto wallets in the Play Store, including Exodus and Klever. After installing either of these wallets, you can purchase cryptocurrency inside the wallet system. This means converting local Guyanese dollars to BTC or USDT.

Octafx uses USDT to deposit, so you can purchase USDT inside your Klever wallet using your Visa card.

Once your klever wallet is funded, you can now transfer the funds into your Octafx broker account and start trading.

I suggest practicing trading on a demo account on Octafx broker before trading on your real accounts. Also, you should do as much research before getting into the live markets. There are people online providing trading signals, but practicing on your own to master the art of trading will do you justice as a forex trader.

What are some do’s and don’ts when trading forex in Guyana?

Here are some do’s and don’ts to consider when trading forex:

Do’s:

Educate Yourself: Continuously educate yourself about forex trading. Understand fundamental analysis, technical analysis, risk management, and trading psychology to make informed decisions.

Use a Demo Account: Before trading with real money, practice trading on a demo account to familiarize yourself with the platform and test your trading strategies without risking capital.

Start Small: Begin with small position sizes and gradually increase as you gain experience and confidence in your trading strategy. Avoid risking too much of your capital on any single trade.

Set Clear Goals: Establish realistic trading goals and develop a trading plan to achieve them. Define your risk tolerance, profit targets, and criteria for entering and exiting trades.

Use Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. This helps protect your capital and prevents emotions from influencing your trading decisions.

Diversify Your Portfolio: Avoid putting all your capital into one currency pair or trading strategy. Diversifying your portfolio can help spread risk and improve overall trading performance.

Stay Informed: Stay updated on economic news, geopolitical events, and other factors that can impact currency markets. Be aware of scheduled economic releases and their potential effects on exchange rates.

Practice Patience and Discipline: Exercise patience and discipline in your trading approach. Avoid chasing trades or letting emotions dictate your decisions. Stick to your trading plan and remain disciplined, even during periods of market volatility.

Don’ts:

Don’t Trade with Money You Can’t Afford to Lose: Avoid trading with funds that you cannot afford to lose. Only trade with disposable income that you can afford to risk.

Don’t Overleverage: Avoid overleveraging your positions, as it can amplify both profits and losses. Use leverage responsibly and consider its impact on your risk management strategy.

Don’t Trade Based on Emotions: Avoid making impulsive decisions driven by fear, greed, or other emotions. Emotional trading often leads to irrational behavior and poor trading outcomes.

Don’t Chase Losses: Avoid trying to recover losses by increasing your position sizes or taking unnecessary risks. Accept losses as a part of trading and stick to your risk management plan.

Don’t Trade Without a Plan: Avoid entering trades without a clear trading plan and defined risk-reward parameters. Trading without a plan is akin to gambling and can lead to inconsistent results.

Don’t Ignore Technical Analysis: While fundamental analysis is important, don’t ignore technical analysis. Utilize technical indicators, chart patterns, and trend analysis to identify potential trade setups and improve your timing.

Don’t Trade During High-Impact News Events: Avoid trading during major economic news releases or geopolitical events that can cause significant market volatility. Wait for calmer market conditions before entering trades.

Don’t Follow the Crowd Blindly: Avoid blindly following tips, recommendations, or trading signals from others without conducting your own analysis. Develop your own trading strategy based on your goals, risk tolerance, and market analysis.

By following these do’s and don’ts, you can improve your chances of success and minimize potential risks when trading forex.

also read Discover How to get an International Bank Account as a Guyanese

![]()