How PayPal Stifles Guyanese from Making Money Online. Hello my brothers and sisters in Guyana In this Blog post I will break down the basic information you need to know about paypal and why Guyanese are Stifled from Growth Online. Before I dive into the Topic Let me Remind you there is a way to purchase cheap domain names for less than $5 on NameCheap. So if you plan to start a website or Blog but need Affordable Domain Name Then namecheap is the platform for you. Now lets go.

Table of Contents

How PayPal Stifles Guyanese from Making Money Online

In a world where digital entrepreneurship and freelancing are rapidly becoming key income sources, platforms like PayPal have emerged as essential tools for conducting online transactions. However, for many people in Guyana, PayPal is more of a barrier than a bridge. The platform’s restrictions on receiving payments in Guyana have made it increasingly difficult for freelancers, online entrepreneurs, and content creators to unlock the full potential of the global digital economy.

Here’s how PayPal’s policies stifle Guyanese from making money online and what alternatives may be available for those looking to tap into the global market.

Restricted Ability to Receive Payments

The most significant barrier for Guyanese users is PayPal’s refusal to allow them to receive payments. While they can send money and make purchases, the inability to receive funds is a serious roadblock for freelancers and small business owners who rely on international clients. Whether you are a freelance graphic designer, a virtual assistant, or someone selling digital products, the inability to receive payments through PayPal effectively closes off the platform as a source of income.

For many people worldwide, PayPal is synonymous with online payments. International clients often prefer using PayPal due to its reputation for security, ease of use, and widespread acceptance. Without access to this platform, Guyanese freelancers are often forced to turn down clients or look for cumbersome workarounds. This puts them at a competitive disadvantage compared to their global counterparts.

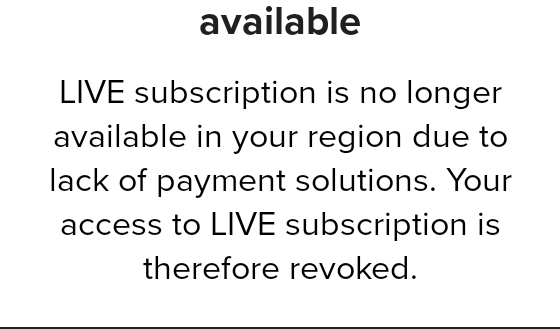

A Few Example of this restriction is Tiktok Live Subscription, In my opinion there are many content creators in this world making a living off tiktok and one of the ways this is possible is through tiktok subscription. A feature where if enabled you can receive $5 per month for every person who subscribe. Without paypal this feature is turned off for Guyana Tiktok Accounts.

Limited Access to Popular Online Platforms

Many global platforms like eBay, Etsy, Fiverr, and Upwork heavily rely on PayPal for receiving payments. Freelancers in Guyana who want to sell products or offer services on these platforms often find themselves excluded. While some of these platforms offer alternative payment methods, they are not always available or convenient in Guyana, pushing potential entrepreneurs out of the market.

This exclusion is particularly frustrating for young Guyanese looking to capitalize on the global gig economy or e-commerce. By not having a reliable payment gateway like PayPal, they lose out on potential income from international customers.

Increased Transaction Costs with Workarounds

Some Guyanese freelancers use foreign bank accounts or partner with intermediaries in countries where PayPal allows full access. However, these solutions come with additional costs and risks. Setting up a foreign bank account or using services like Payoneer can lead to high transaction fees and currency conversion losses. Freelancers who use intermediaries often pay hefty commissions, reducing their already thin profit margins.

Additionally, there’s the issue of trust. Working through intermediaries involves handing over sensitive financial details, which can sometimes lead to fraud or scams. The need for these workarounds highlights how PayPal’s restrictions create financial inefficiencies for Guyanese entrepreneurs and freelancers.

Hindrance to the Growth of E-Commerce

Guyana’s e-commerce scene is still growing, and platforms like PayPal play a pivotal role in online retail worldwide. PayPal’s restrictions make it difficult for local e-commerce businesses to scale or tap into international markets. Without a smooth, trusted payment method like PayPal, many local e-commerce stores struggle to gain the trust of international customers who might be reluctant to use unfamiliar or lesser-known payment methods.

This situation prevents local sellers from leveraging the full potential of digital commerce and limits their ability to grow and expand into new markets. In an increasingly global economy, Guyanese entrepreneurs are left with fewer options to compete.

Loss of Trust with International Clients

Many freelancers in Guyana face challenges when trying to convince international clients to use alternative payment methods. Clients accustomed to PayPal may view lesser-known platforms like Skrill or Payoneer as less secure or reliable, leading to mistrust. This added friction in securing payments can result in lost business, with clients opting to hire someone else who offers a more seamless payment process.

Trust is a key factor in international business. The inability to offer clients an easy and familiar payment solution like PayPal can erode that trust and lead to missed opportunities.

The Search for Alternatives

Despite these obstacles, Guyanese freelancers and entrepreneurs are not without hope. Several alternative platforms offer payment solutions:

Payoneer: Payoneer is one of the most popular alternatives, especially for freelancers. It offers multi-currency accounts and allows users to receive payments from various platforms, including Upwork and Fiverr.

Skrill: Skrill is another option that allows Guyanese to receive international payments. However, its fees can be higher compared to PayPal, and it’s not as widely accepted.

Cryptocurrency: For tech-savvy individuals, cryptocurrency provides a decentralized way to receive payments without geographical restrictions. Though not yet widely adopted, this option has potential, especially for digital products and tech-based services.

PayPal’s restrictions on receiving payments in Guyana have severely limited the earning potential of the country’s freelancers, entrepreneurs, and digital content creators. While alternative platforms exist, none have the reach, trust, and ease of use that PayPal offers. Until PayPal revisits its policies, Guyanese will continue to face challenges in fully participating in the global digital economy.

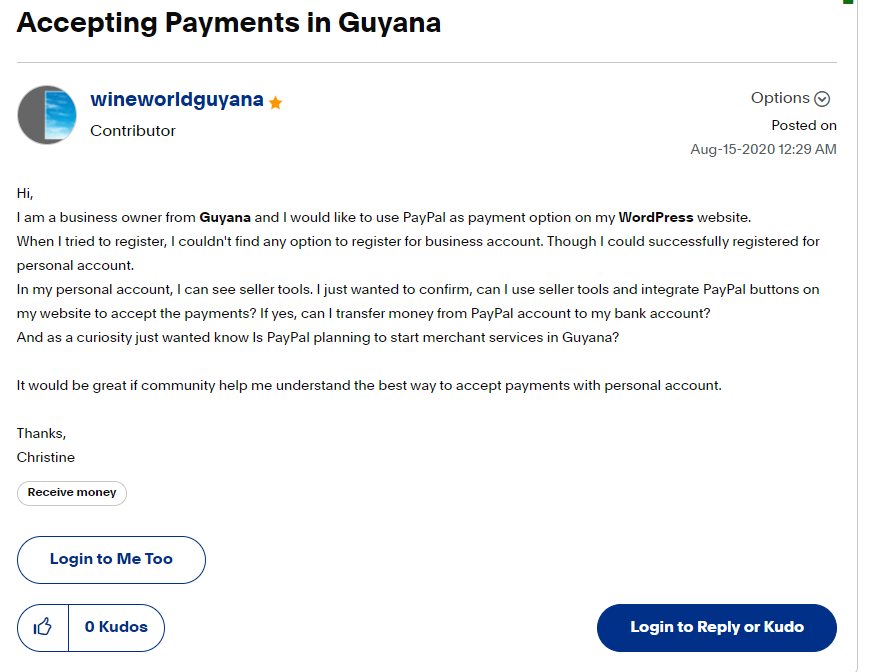

I did some searching and found the reason pay pal does not work here may be due to the Government Interventions In deed. Take a Look at this Question that was asked by one Individual in the Paypal Community in 2020.

The Business Owner was seeking a way to link pay pal to their business for expansion. A representative from paypal responded quoting ” The option to ‘receive’ paypal payments is sadly not available in Guyana. You can only ‘send’ payments for purchases. Paypal varies a lot country to country and can only offer the services that the banks / governments of that country allow it to offer.

There are quite a few countries unable to receive paypal payments. With this response it means for paypal to work in Guyana approval is needed from the Government’s Intervention and maybe the banks as well.

Will there be a Solution ? I doubt.

In a world that is increasingly moving online, PayPal’s policies are a frustrating reminder of the uneven playing field that still exists for developing countries like Guyana. But as the digital landscape evolves, alternative payment solutions may become more accessible and widely adopted, offering hope for a more inclusive future.

But all hope is not lost if you are planning to work online check out my other article here Discover How to get an international bank account as a Guyanese . This article will help you get an International Bank Account to Accept payments online.

![]()

2 thoughts on “How PayPal Stifles Guyanese from Making Money Online”

Comments are closed.